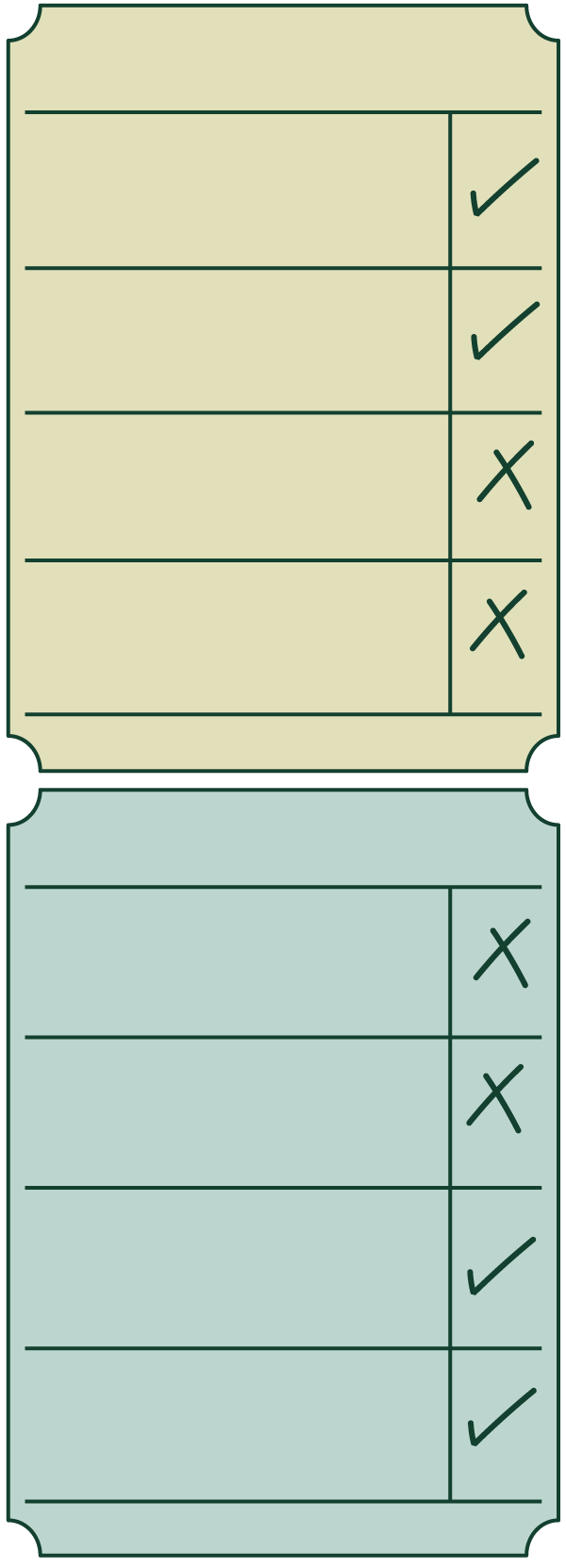

Mandatory Market

Are credits compulsory for

carbon emitting businesses

and industries? Yes

Are credits based on demand

and supply, and priced

similarly? Yes

Are the prices of credits

dependent on a specific

carbon offsetting project? No

Are the prices of credits

dependent on the buyer’s

interests? No

Voluntary Market

Are credits compulsory for

carbon emitting businesses

and industries? Yes

Are credits based on demand

and supply, and priced

similarly? Yes

Are the prices of credits

dependent on a specific

carbon offsetting project? No

Are the prices of credits

dependent on the buyer’s

interests? No

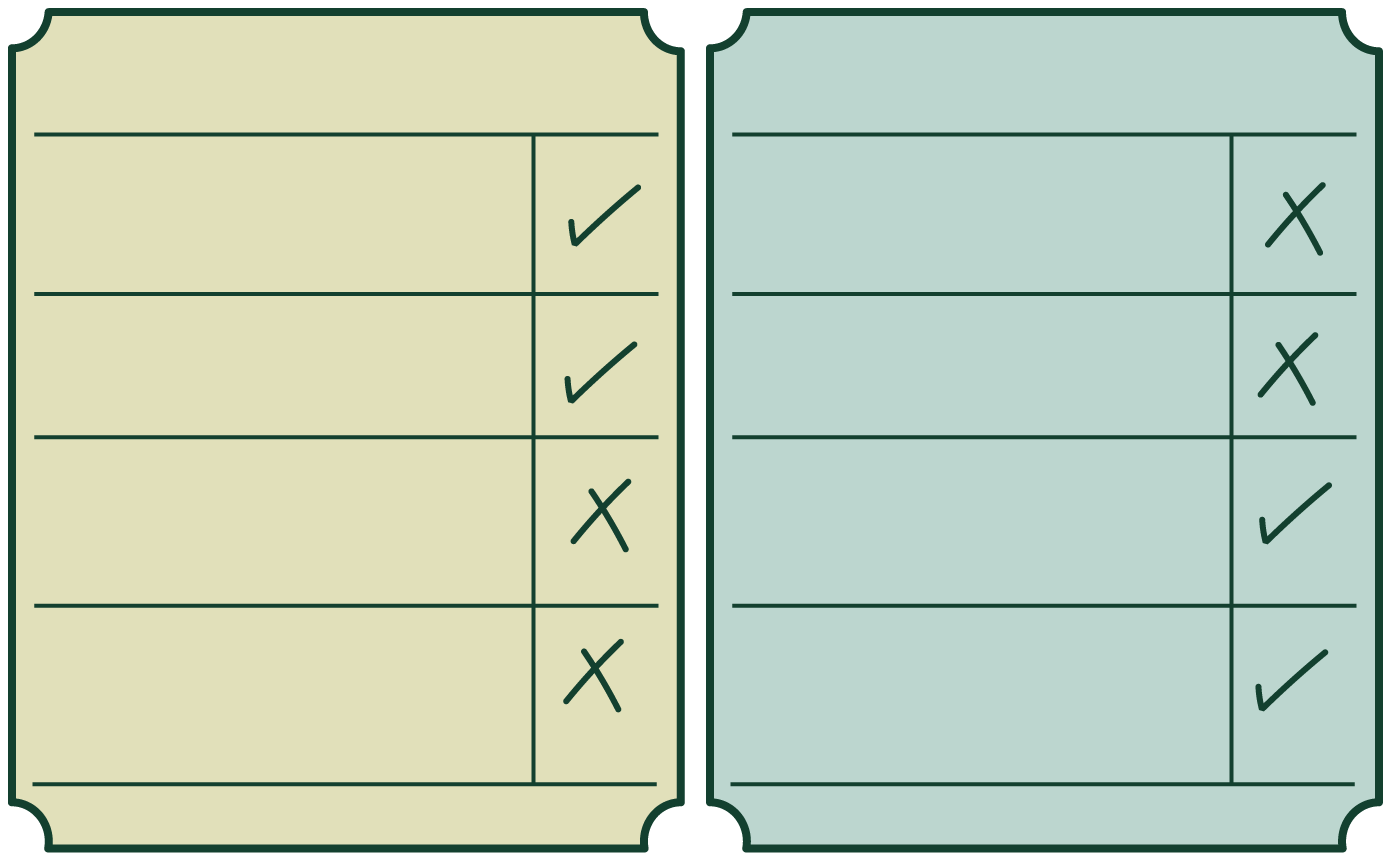

Mandatory Market

Voluntary Market

Are credits compulsory for

carbon emitting businesses

and industries? Yes

Are credits compulsory for

carbon emitting businesses

and industries? Yes

Are credits based on demand

and supply, and priced similarly?

Yes

Are credits based on demand

and supply, and priced similarly?

Yes

Are the prices of credits

dependent on a specific

carbon offsetting project? No

Are the prices of credits

dependent on a specific

carbon offsetting project? No

Are the prices of credits

dependent on the buyer’s

interests? No

Are the prices of credits

dependent on the buyer’s

interests? No

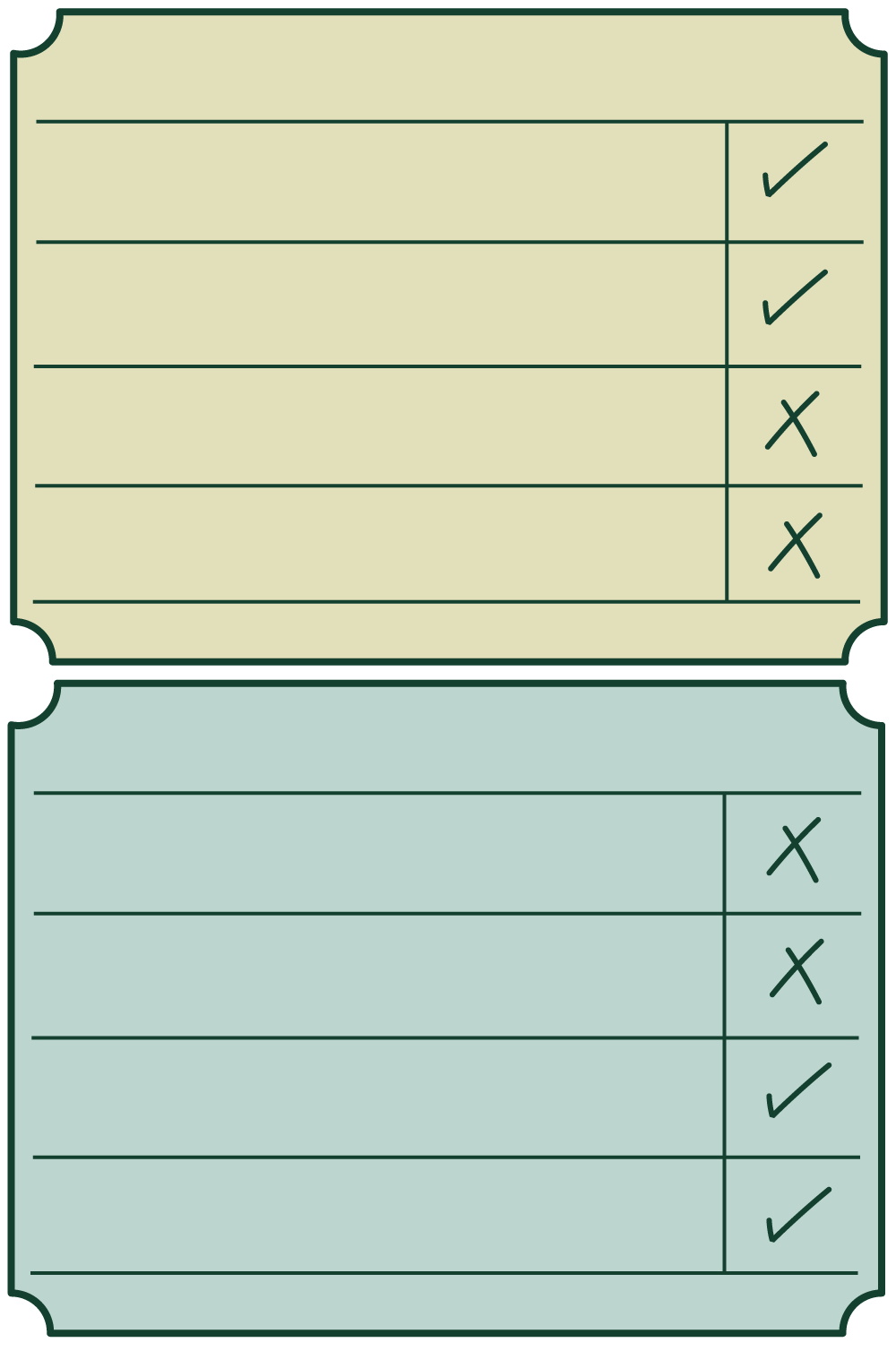

Mandatory Market

Are credits compulsory for carbon emitting

businesses and industries? Yes

Are credits based on demand and supply, and

priced similarly? Yes

Are the prices of credits dependent on a specific

carbon offsetting project? No

Are the prices of credits dependent on the buyer’s

interests? No

Voluntary Market

Are credits compulsory for carbon emitting

businesses and industries? Yes

Are credits based on demand and supply, and

priced similarly? Yes

Are the prices of credits dependent on a specific

carbon offsetting project? No

Are the prices of credits dependent on the buyer’s

interests? No