At its heart, the carbon market is about the relationship between the credit buyer and project developer (or credit supplier). But there are more players and layers to the market to make sense of.

I know who Project Developers are... but what are the others?

So many things to know!

In reality, the system is much more complex than that.

Project

Developers

Establish the projects, calculate emissions reductions impacts, generate credits based on them, and sell these credits.

Independently check if projects and credits are legitimate before projects are registered. Also run checks on ongoing projects.

Third-party

Auditors

Carbon Exchanges

Essentially “marketplaces”

for carbon credits; buyer

doesn’t have to buy from

project developers

directly.

Carbon Retailers

Offer a range of credits for

buyers to purchase; buyer

doesn’t have to buy from

project developer directly.

Carbon Offset

Programmes

Set standards for and

certifies carbon credits;

they also issue credits

themselves.

At its heart, the carbon market is about the relationship between the credit buyer and project developer (or credit supplier). But there are more players and layers to the market to make sense of.

I know who Project Developers are... but what are the others?

So many things to know!

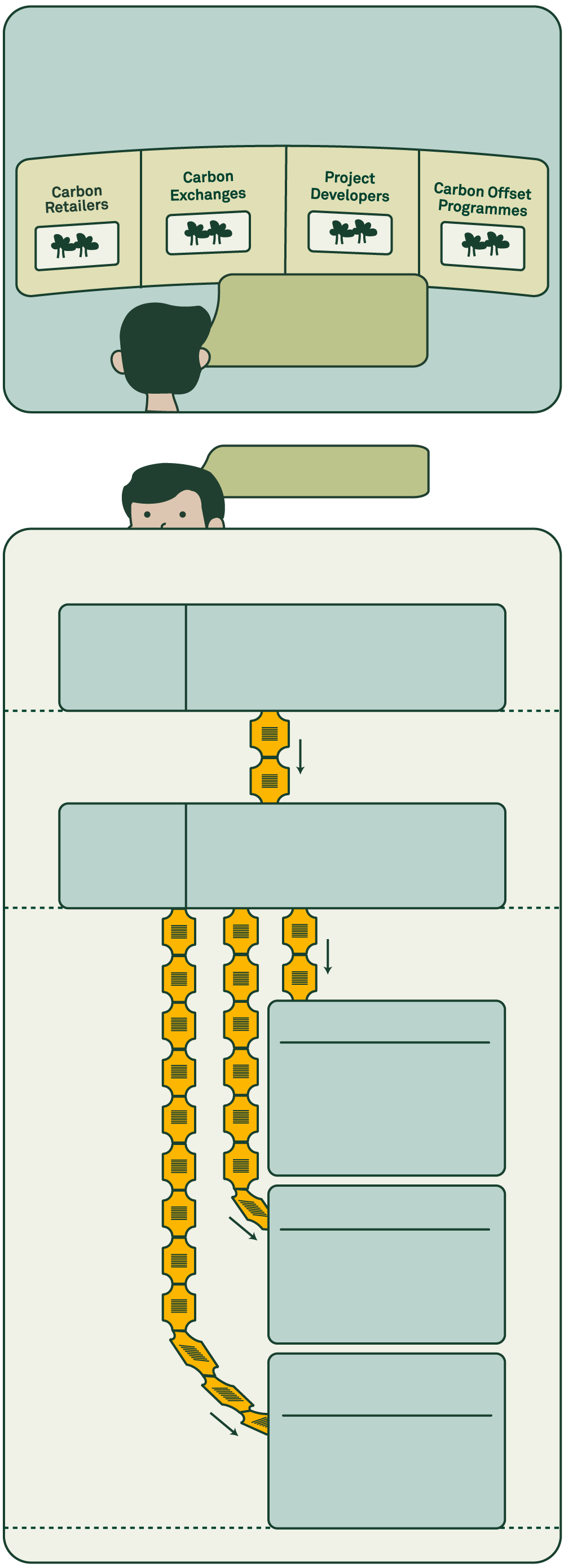

In reality, the system is much more complex than that.

Establish the projects, calculate emissions reductions impacts, generate credits based on them, and sell these credits.

Project Developers

Independently check if projects and credits are legitimate before projects are registered. Also run checks on ongoing projects.

Third-party

Auditors

Carbon

Retailers

Carbon Offset

Programmes

Carbon

Exchanges

Offer a range of credits for

buyers to purchase; buyer

doesn’t have to buy from

project developer directly.

Set standards for and

certifies carbon credits;

they also issue credits

themselves.

Essentially “marketplaces”

for carbon credits; buyer

doesn’t have to buy from

project developers directly.

At its heart, the carbon market is about the relationship between the credit buyer and project developer (or credit supplier). But there are more players and layers to the market to make sense of.

I know who Project Developers are... but what are the others?

So many things to know!

In reality, the system is much more complex than that.

Project

Developers

Establish the projects, calculate emissions reductions impacts, generate credits based on them, and sell these credits.

Independently check if projects and credits are legitimate before projects are registered. Also run checks on ongoing projects.

Third-party

Auditors

Carbon Exchanges

Essentially “marketplaces”

for carbon credits; buyer

doesn’t have to buy from

project developers

directly.

Carbon Retailers

Offer a range of credits for

buyers to purchase; buyer

doesn’t have to buy from

project developer directly.

Carbon Offset

Programmes

Set standards for and

certifies carbon credits;

they also issue credits

themselves.